Education and income inequality is a huge problem in America. Income and education, with regards to SAT scores, are highly correlated.

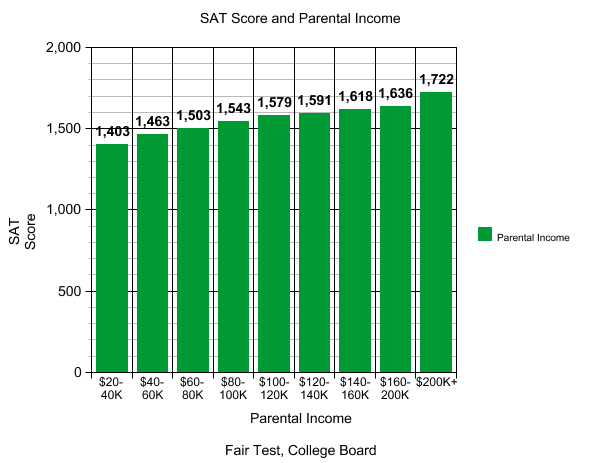

The above graph illustrates this phenomenon. Those taking the SAT with 20-40K parental income score around 1400. Those with 200K or more in parental income score over 1700. This is no one-time fluke, either – the scores increase almost linearly with income, with no dips or deviations. This means that wealthy kids are not only better suited to pay for college, but they are more likely to have the scores that make admission a breeze.

One of the most commonly held beliefs about the gap between test scores is that wealthier kids can afford to get test prep. First of all, if external help and preparation can influence an SAT score, then is it really an objective, reliable and valid measure of aptitude? Many research studies suggest that test prep has a limited effect on scores, boosting them only a few meager points. The gap between the 20K income score and the 200K income score is too big of a disparity to be explained by SAT prep books or courses.

Instead of a single-factor model, we must see the income and education inequality problem with a multi-factorial approach. Wealthier families tend to locate in areas with better schools. Parents with a higher income tend to be college educated and take great care to see their children do well on tests and get into a good college. Test scores lead to college, which leads to income… which, as we see, leads right back to SAT scores.

Education has historically been viewed as a great equalizer in America. It was education that was supposed to help underprivileged children and improve their chances for success in life. Not anymore, and the education-achievement gap is only widening. Sean F. Reardon, a Stanford University sociologist, led a study that found the gap in test scores between wealthy and poor students had grown about 40% since the 1960s.

Another variable that helps to explain the gap is that wealthier families have more resources to devote to their children. From birth, education is a vital component of an upper-middle class child’s life. The vocabulary he/she hears is more varied and richer, there are more books in the household and parents take an active interest in the child’s academic performance. All this leads to the cycle of test scores, income, repeat.

“The pattern of privileged families today is intensive cultivation” – Dr. Furstenberg, sociology professor at the University of Pennsylvania

Does the data surprise you? Did you realize the gap was this big? Leave your thoughts in the comments section below.

The above graph illustrates this phenomenon. Those taking the SAT with 20-40K parental income score around 1400. Those with 200K or more in parental income score over 1700. This is no one-time fluke, either – the scores increase almost linearly with income, with no dips or deviations. This means that wealthy kids are not only better suited to pay for college, but they are more likely to have the scores that make admission a breeze.

One of the most commonly held beliefs about the gap between test scores is that wealthier kids can afford to get test prep. First of all, if external help and preparation can influence an SAT score, then is it really an objective, reliable and valid measure of aptitude? Many research studies suggest that test prep has a limited effect on scores, boosting them only a few meager points. The gap between the 20K income score and the 200K income score is too big of a disparity to be explained by SAT prep books or courses.

Instead of a single-factor model, we must see the income and education inequality problem with a multi-factorial approach. Wealthier families tend to locate in areas with better schools. Parents with a higher income tend to be college educated and take great care to see their children do well on tests and get into a good college. Test scores lead to college, which leads to income… which, as we see, leads right back to SAT scores.

Education has historically been viewed as a great equalizer in America. It was education that was supposed to help underprivileged children and improve their chances for success in life. Not anymore, and the education-achievement gap is only widening. Sean F. Reardon, a Stanford University sociologist, led a study that found the gap in test scores between wealthy and poor students had grown about 40% since the 1960s.

Another variable that helps to explain the gap is that wealthier families have more resources to devote to their children. From birth, education is a vital component of an upper-middle class child’s life. The vocabulary he/she hears is more varied and richer, there are more books in the household and parents take an active interest in the child’s academic performance. All this leads to the cycle of test scores, income, repeat.

“The pattern of privileged families today is intensive cultivation” – Dr. Furstenberg, sociology professor at the University of Pennsylvania

Does the data surprise you? Did you realize the gap was this big? Leave your thoughts in the comments section below.

While income and education, on average, go hand-in-hand, it’s surprising how much of an advantage wealthier kids actually get. Let’s start by discussing SAT scores.

The Scholastic Aptitude Test has long been a measure of how well a student is expected to perform in college. Although many arguments have been made against this one-shot, G-loaded test, it remains in use as the most powerful predictor (supposedly) of academic performance. The bad news is that familial income and standardized test scores are highly correlated.

The Scholastic Aptitude Test has long been a measure of how well a student is expected to perform in college. Although many arguments have been made against this one-shot, G-loaded test, it remains in use as the most powerful predictor (supposedly) of academic performance. The bad news is that familial income and standardized test scores are highly correlated.