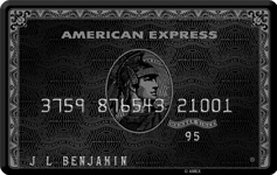

Amex Centurion, also known as “The Black Card”, was once the stuff of urban legend, rumored to an ultra-rare credit card given only to the wealthiest of people. For the past sixteen years, it has been a reality.

American Express created the Centurion Card, which is so exclusive it is invitation-only. The card is meant for big spenders, but even a $10 million net worth isn’t much to Amex Black Card holders. The average Centurion cardholder has over $16 million in assets and a $1 million per year income.

To get one, you’ll need a perfect, or nearly perfect, credit history. You’ll also need to charge (and pay off) at least $250,000 per year to your existing credit card per year. This means you’ll have to spend $21,000 per month… minimum. Oh, and the card has no interest, because the balance is due in full each month.

You can ask for an invitation by calling 1-800-263-1616, but be prepared to answer some tough questions about your income and credit history. You can also view the cardmember agreement here.

If you’re offered the card, you’ll have to pay a one-time initiation fee and an annual fee of $2,500 per card. These are the highest fees of any card on the market, and if you want to get your spouse a Centurion card, prepare to pay even more.

But the benefits… they’re sweet!

The actual benefit programs and their details are a secret, some of them are known, such as:

American Express created the Centurion Card, which is so exclusive it is invitation-only. The card is meant for big spenders, but even a $10 million net worth isn’t much to Amex Black Card holders. The average Centurion cardholder has over $16 million in assets and a $1 million per year income.

To get one, you’ll need a perfect, or nearly perfect, credit history. You’ll also need to charge (and pay off) at least $250,000 per year to your existing credit card per year. This means you’ll have to spend $21,000 per month… minimum. Oh, and the card has no interest, because the balance is due in full each month.

You can ask for an invitation by calling 1-800-263-1616, but be prepared to answer some tough questions about your income and credit history. You can also view the cardmember agreement here.

If you’re offered the card, you’ll have to pay a one-time initiation fee and an annual fee of $2,500 per card. These are the highest fees of any card on the market, and if you want to get your spouse a Centurion card, prepare to pay even more.

But the benefits… they’re sweet!

The actual benefit programs and their details are a secret, some of them are known, such as:

- Centurion concierge service – word on the street is that you can get just about any hotel room, restaurant table, or flight you want. A famous Centurion story involves a concierge who tracked down Kevin Costner’s “Dances With Wolves” horse for a cardholder who wanted to buy it.

- A $200 qualifying airline rebate, per year, to the airline of your choice. This credit can be applied to baggage fees, in-flight food and drink, etc.

- Car rental perks – you get preferred pricing on vehicles such as Ferraris and Mercedes.

- Hertz Platinum and Avis President’s Club membership – this gets you guaranteed vehicle availability and upgrades, and a four-hour grace period on returns.

- Travel accident coverage for death or dismemberment up to $1.5 million. This is the highest of any card that offers this benefit. If the entire fare of your travel has been charged to the card, you’re covered. Your spouse, as well as dependent children under 23, are also covered.

- Return protection – if you change your mind and want to return an item, even if the merchant won’t take it back, American Express will refund the charge, up to $300 per purchase and $1,000 per year.

- Personal shopper services at select retailers.

- Access to airport lounges – the card lets you get into Delta Sky Clubs and over 600 other lounges.

- Starwood Gold status – this will give you complimentary room upgrades, 4 p.m. late checkout and better customer service.

- No other form of payment is equivalent to the card’s status symbol of wealt

- These aren’t all the benefits of the card, but like I said, American Express doesn’t release much information about this exclusive card. It’s likely to be most useful to big spenders who will be travelling often. If you can derive value from the benefits, it seems to be well worth the annual fee.