If you were going through the marshmallow test (I'll tell you about that in a minute), could you delay gratification? Do you have any self-control? If you were a kid again, could you show any restraint if delicious marshmallows were placed in front of you?

Finance for children can be a tricky topic. Parents want to find ways to teach their kids about money and saving, but money may have been taboo in their own home. Forget all the silly games you may read or hear about – here is THE most important thing you can teach your kids about money.

DELAYED GRATIFICATION.

If you can raise children with the ability to delay gratification, you have succeeded as a parent. But before I get to the money part, let’s talk about marshmallows.

In the 1960s, Walter Mischel of Stanford conducted significant psychological studies with children, revealing what is now believed to be the most important characteristic for overall life success. The psychology behind self-control and the delay of gratification is truly remarkable.

A child was brought into a private room and placed in front of a marshmallow. The researcher told the kid that he was leaving the room and if the marshmallow wasn’t eaten when he came back, the reward would be another marshmallow. If the child decided to eat the first marshmallow, there’d be no second. Then the researcher left, and the kids writhed and jittered in their seats, trying hard to restrain themselves. Only a few kids managed to wait the entire time. Below is a YouTube video demonstrating the experiment.

If you want to learn more about the experiment, there is a book about it. It's called The Marshmallow Test: Why Self-Control is the Engine of Success

Finance for children can be a tricky topic. Parents want to find ways to teach their kids about money and saving, but money may have been taboo in their own home. Forget all the silly games you may read or hear about – here is THE most important thing you can teach your kids about money.

DELAYED GRATIFICATION.

If you can raise children with the ability to delay gratification, you have succeeded as a parent. But before I get to the money part, let’s talk about marshmallows.

In the 1960s, Walter Mischel of Stanford conducted significant psychological studies with children, revealing what is now believed to be the most important characteristic for overall life success. The psychology behind self-control and the delay of gratification is truly remarkable.

A child was brought into a private room and placed in front of a marshmallow. The researcher told the kid that he was leaving the room and if the marshmallow wasn’t eaten when he came back, the reward would be another marshmallow. If the child decided to eat the first marshmallow, there’d be no second. Then the researcher left, and the kids writhed and jittered in their seats, trying hard to restrain themselves. Only a few kids managed to wait the entire time. Below is a YouTube video demonstrating the experiment.

If you want to learn more about the experiment, there is a book about it. It's called The Marshmallow Test: Why Self-Control is the Engine of Success

Here’s the kicker – as the years went on, the researchers did longitudinal research and observed each child’s progress in different areas of life. They found that children who delayed gratification had:

This is why it’s incredibly important to let your kids understand that a “no” today means a better “yes” tomorrow. Be open with your kids about the cost of things. Parents have a hard time telling their children “no” in the first place. Make it a little easier by reminding them of something the “no” will lead to in the future. If a child asks for an expensive new toy, explain to him that you’re saving money for a vacation in a few months. In order to have fun on this vacation, you’ll have to give up a few things now.

Likewise, it is important for children to understand that they may have to wait and buy something they want. With access to easy credit, payday loans and overdraft, delayed gratification seems like a thing of the past. Americans had a negative savings rate not too long ago (I’m not too sure if they still do now, I couldn’t find a source) and unnecessary debt funnels wealth away from its owners. Let your children know that if they really want something, they should wait and save to buy it. This will create a foundation for your child, letting him understand that it’s unwise to pay high interest on unnecessary debt later in life. If you child really wants to buy something, make it goal for them to save towards it (by using their allowance of course!).

As your child gets older, he should understand he should use a credit card only if he can pay the full balance each month. Here at Personal Finance Genius, we understand that emergencies occur and some debt must be leveraged. However, credit cards can also be a wonderful tool for building credit and getting some rewards/airline miles. On the other hand, if everyday items are charged, the credit line is lessened, should an emergency ever occur. This is a personal choice that every family should make regarding credit. Let your child know that a poor credit history will make it difficult to buy a car, a home or even a job, if potential employers check credit.

If you can successfully delay gratification, congratulate yourself. You are not like many other Americans. Like many other problems, it can be prevented at home. If you truly love your children you will take control and provide them with this essential life skill.

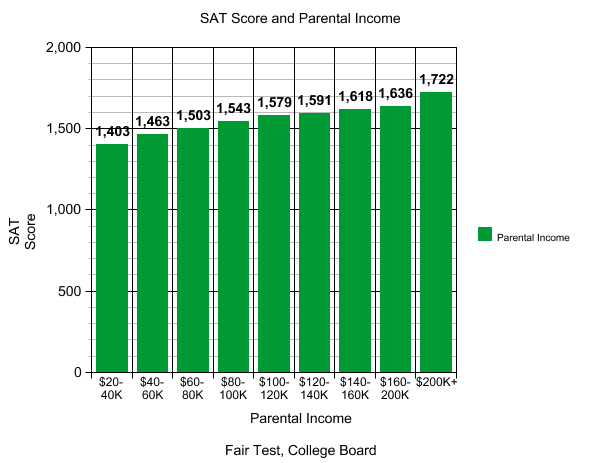

- Higher SAT scores

- Better responses to stress

- Lower levels of drug abuse

- Lower probability of obesity

This is why it’s incredibly important to let your kids understand that a “no” today means a better “yes” tomorrow. Be open with your kids about the cost of things. Parents have a hard time telling their children “no” in the first place. Make it a little easier by reminding them of something the “no” will lead to in the future. If a child asks for an expensive new toy, explain to him that you’re saving money for a vacation in a few months. In order to have fun on this vacation, you’ll have to give up a few things now.

Likewise, it is important for children to understand that they may have to wait and buy something they want. With access to easy credit, payday loans and overdraft, delayed gratification seems like a thing of the past. Americans had a negative savings rate not too long ago (I’m not too sure if they still do now, I couldn’t find a source) and unnecessary debt funnels wealth away from its owners. Let your children know that if they really want something, they should wait and save to buy it. This will create a foundation for your child, letting him understand that it’s unwise to pay high interest on unnecessary debt later in life. If you child really wants to buy something, make it goal for them to save towards it (by using their allowance of course!).

As your child gets older, he should understand he should use a credit card only if he can pay the full balance each month. Here at Personal Finance Genius, we understand that emergencies occur and some debt must be leveraged. However, credit cards can also be a wonderful tool for building credit and getting some rewards/airline miles. On the other hand, if everyday items are charged, the credit line is lessened, should an emergency ever occur. This is a personal choice that every family should make regarding credit. Let your child know that a poor credit history will make it difficult to buy a car, a home or even a job, if potential employers check credit.

If you can successfully delay gratification, congratulate yourself. You are not like many other Americans. Like many other problems, it can be prevented at home. If you truly love your children you will take control and provide them with this essential life skill.