Author: Patricia Sanders

If you ask “how much will your lifestyle cost?”, then the answer will be: our costs depends on the kind of lifestyle we want. Some people love to live a modest lifestyle while others desire a lifestyle full of entertainment and luxury. Each lifestyle says something about how the person wants to live life. So you’ll never be able to draw a parameter of comfort when it comes to living your life. However, your lifestyle will depend on your income. Money gives us the freedom to live life on our own. But you must consider saving money to steadily maintain your lifestyle.

How much money do you need?

Knowing your net worth is certainly important or else you can't get the exact idea about what you want. So assess how much you earn, your total assets, and your liabilities. Thus, you can set up your financial priorities.

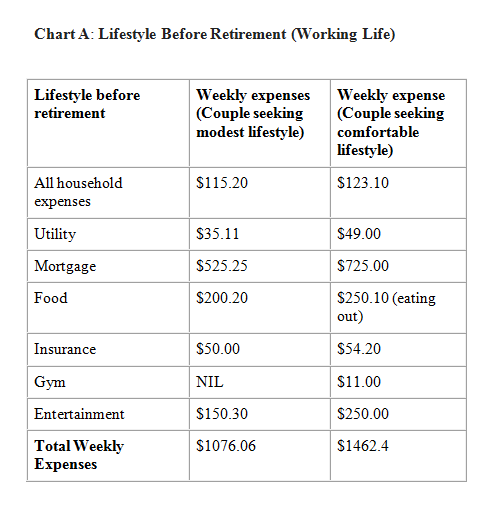

Below are two charts showing weekly expenses of two lifestyles: a) Lifestyle before retirement (working life) b) Lifestyle after retirement. The numbers are based on assumptions and can vary. You can get an overall idea of expenses of working life and retirement life from these charts.

How much money do you need?

Knowing your net worth is certainly important or else you can't get the exact idea about what you want. So assess how much you earn, your total assets, and your liabilities. Thus, you can set up your financial priorities.

Below are two charts showing weekly expenses of two lifestyles: a) Lifestyle before retirement (working life) b) Lifestyle after retirement. The numbers are based on assumptions and can vary. You can get an overall idea of expenses of working life and retirement life from these charts.

5 Tips to Maintain a Comfortable Lifestyle

Some of you love to live a lavish lifestyle, and some of you may prefer living a modest lifestyle. Whatever your choice, you should live a lifestyle that’s within your means. Below are some tips you must follow.

1. Formulate your own budget

Many people think that following a budget means living a strict life, which can limit their luxury. However, the idea is not true. Following a budget is important to achieve financial freedom. Budgeting is tough, but it’s not a pause for your comfort. It helps you to understand where your money is going and how you can limit your expenses.

2. Save as much as possible to achieve financial freedom

To maintain a comfortable lifestyle you have to concentrate on money saving. Earning a huge amount of money can give you the freedom to live lavishly. However, if you don't save, then you’re certainly ruining your financial future. Simply earning money is not enough. You should save as much as possible to confirm lifetime financial freedom.

3. Protect your golden age

Make sure you're saving in the right way to fund your retirement. Always try to maximize your income in retirement. You should start saving for retirement today, so you’ll be able to achieve the lifestyle you want.

4. Adopt frugal lifestyle

The most prudent way of living financially comfortable life is by adopting a frugal life. This doesn’t mean you have to segregate yourself from the enjoyment. Rather, you can save more money to secure your future.

5. Use online calculators

You will never want things to go wrong with regards to your mortgage, savings, retirement, and so on. Using free online calculators will help you in determining values and taking the right decision. Go online to get a different type of calculators which will help you in the calculation. You can get a free mortgage calculator, retirement calculator, pension calculator.

Bottom line

Achieving financial goals is important. However, saving millions of dollars shouldn't be your sole financial goal. Paying utility bills, buying essential household items, buying a house are also part of the financial goal. To achieve these goals, you need to make financial planning.

Remember, planning is the key and it’s never too early to start your planning. Start planning and step forward to achieve your financial goals.

Some of you love to live a lavish lifestyle, and some of you may prefer living a modest lifestyle. Whatever your choice, you should live a lifestyle that’s within your means. Below are some tips you must follow.

1. Formulate your own budget

Many people think that following a budget means living a strict life, which can limit their luxury. However, the idea is not true. Following a budget is important to achieve financial freedom. Budgeting is tough, but it’s not a pause for your comfort. It helps you to understand where your money is going and how you can limit your expenses.

2. Save as much as possible to achieve financial freedom

To maintain a comfortable lifestyle you have to concentrate on money saving. Earning a huge amount of money can give you the freedom to live lavishly. However, if you don't save, then you’re certainly ruining your financial future. Simply earning money is not enough. You should save as much as possible to confirm lifetime financial freedom.

3. Protect your golden age

Make sure you're saving in the right way to fund your retirement. Always try to maximize your income in retirement. You should start saving for retirement today, so you’ll be able to achieve the lifestyle you want.

4. Adopt frugal lifestyle

The most prudent way of living financially comfortable life is by adopting a frugal life. This doesn’t mean you have to segregate yourself from the enjoyment. Rather, you can save more money to secure your future.

5. Use online calculators

You will never want things to go wrong with regards to your mortgage, savings, retirement, and so on. Using free online calculators will help you in determining values and taking the right decision. Go online to get a different type of calculators which will help you in the calculation. You can get a free mortgage calculator, retirement calculator, pension calculator.

Bottom line

Achieving financial goals is important. However, saving millions of dollars shouldn't be your sole financial goal. Paying utility bills, buying essential household items, buying a house are also part of the financial goal. To achieve these goals, you need to make financial planning.

Remember, planning is the key and it’s never too early to start your planning. Start planning and step forward to achieve your financial goals.

Author Bio: Patricia Sanders is a freelance writer. She is associated with Debt Consolidation Care Community. She loves to write on various topics, especially finance. Her writing helps people to get useful suggestions and financial insight to solve their problems.